Kashflow User Review 2014

I moved from QuickBooks to Kashflow in April 2012 and more than two years on I haven’t looked back. I felt driven to find a cloud based accounting system in order to provide the freedom to work on multiple devices and manage my accounts where ever I was. At the time I looked at two other systems – Freshbooks and Xero. I took out a trial for all three, and conducted day to day tasks such as Invoice creation, Purchases and Reporting with all of them, I quickly established that Kashflow was the most user friendly and best suited to my needs.

Here’s a quick summary of the pros and cons of Kashflow as at August 2014 – this is based on my small to medium sized Market Research & Consultancy business which is set up on a Self Employed / Sole Trader basis but is VAT registered requiring quarterly VAT returns.

Pros

-

- Great value. All Kashflow tiers are excellent value for money. Kashflow pricing starts at £5 + VAT per month (for up to 10 invoices per month). I have the £10 + VAT per month account and I’m very happy with it. The one above, £15 + VAT includes additional features such as RTI compliant Payroll, Automatic RTI Submissions, Payslip Generation, Bookkeeping integration and Employee absence calendar

- Cloud-based. As a small to medium sized business, I see no reason to move to anything but a cloud-based accounting system. When I used QuickBooks (2010 – 2012) I always felt so tied down to my one laptop, software upgrades etc. and it felt a very insecure way of holding the most important information on a business. I’ve never regretted the move to a cloud-based system – I love being able to access my bookkeeping where ever I am, to add receipts via the app or raise an invoice on my laptop while I’m travelling for work.

- Easy to Use. Out of the three systems I trialed a couple of years ago, Kashflow was definitely the most user friendly – the quickest to create an attractive invoice on and the most intuitive to find my way around. Once the decision was made, I switched systems at the beginning of a financial year to ease the change. Transitioning your accounts to a new system is never going to be pain free, and it did feel like a lot of effort in those first few months to set up the various accounts, check Profit & Loss reporting was working in the way you expect, create repeat payments etc., but I always found Kashflow to be intuitive and easy to use.

- Quick & Easy Invoicing. I love the invoicing function in Kashflow – it didn’t take me very long to create an attractive invoice with my logo, details etc. and once that’s done creating an invoice literally takes a matter of minutes. You can choose to auto-remind the client to pay – or in my case, I opt to receive email notification from Kashflow myself when an invoice is overdue and then decide how to proceed. For some clients, I might just leave it another week to see if they get around to paying without prompting, for others, I call their accounts team and for some I call the client directly – all depending on how the client works. What’s great is the little prompt from Kashflow via email – and if you prefer not to have that, you can turn the notifications off and simply filter your invoices by ‘Overdue’ or ‘Unpaid’.

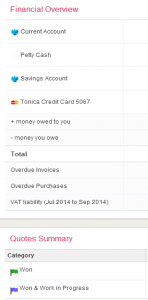

- Dashboard: The Kashflow Dashboard really helps you see where you are with money – what’s in the bank, what’s owed to you, your VAT liability and projects you will invoice for soon (see ‘Quotes’ below). I use it all the time – particularly for my VAT liability. Outside Kashflow I have a simple Excel spreadsheet which I use to work out how much I can pay myself, it takes into account likely Self Assessment tax, any large bills that haven’t come in yet etc.

- Quote function. I prepare bespoke proposals for my clients so wasn’t particularly interested in the Quote function initially. However, I found it to be incredibly useful – when a client commissions a project I create the quote for the work on Kashflow, just for my own tracking. That quote can be given a category – for example, I have mine set as: ‘Proposal Sent’, ‘Won’, ‘Won & Work in Progress’ and the most frustrating one which thankfully doesn’t happen that often … ‘Project gone silent’. The Kashflow dashboard then cleverly shows you the sum of your quotes depending on your settings – for example, I have mine set to ‘Won’ and ‘Won & Work in Progress’ so I know how much work I will invoice in the near future. The great thing about creating quotes is that you never forget to invoice a project, ideal for day rate work as you can just pop on the extra few hours / day charges when they happen. They are also extremely easy to convert into an invoice when you’re ready to do that.

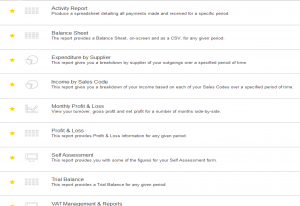

- Reports. There are a myriad of really useful reports in Kashflow all available at the click of a button. You can create your own set of ‘Favourite’ reports which are really handy – my favourite reports include: Balance Sheet; Expenditure by Supplier; Income by Sales Code; Profit & Loss; Self Assessment; VAT Management & Reports and various ones I use at the end of a financial year as a disaster recovery tool (e.g. Activity Report, Trial Balance etc.)

- Customer Stats. For each of your customers you can quickly check statistics on when you first invoiced them, last invoiced, the total invoiced, the amount due (and overdue) and their average time to pay. You can also look at similar statistics for your Suppliers.

- Repeat Purchases. We all have monthly costs that pretty much remain unchanged month to month and I love this tool in Kashflow, you set up the repeat purchase, frequency, amount, payment and type of purchase and then it creates it automatically each time. It also allows me to do a quick review of my monthly costs and try to cut them down – for example, cancelling software subscriptions that I no longer use

- VAT Submissions. I do quarterly VAT submissions to HMRC and I find Kashflow much easier to use than Quickbooks in this regard. You can click from the dashboard through to your VAT liability and proceed to HMRC submission once your accounts are linked. You just need to remember to actually pay HMRC (e.g. via BillPay) and record the VAT payment – everything else is handled by Kashflow

- Bank Reconciliation. Ok so I’m a little sad but I love this part of the system. You can simply click Reconcile on a particular bank account and tick off the purchases and invoices according to your statements – when it balances you get a nice ‘success’ message and can hit reconcile, then lock the transactions and you’re done. It’s easy to click in and out of purchases to make sure they match – for example, many software products I have on a monthly basis are in dollars so although my Repeat Purchase handles them in principle, the amount and payment might need tweaking by a few pence as exchange rates vary month on month. Using a browser with separate tabs allows you to have the reconciliation screen in one tab and another fixing the purchases to exactly match.

- Projects. I’ve only started using the Project functionality recently but I like the idea of being able to look at a project in isolation and check the Income and Expenditure.

Cons / Frustrations

It’s worth saying that this software is cloud based so many tiny niggles over the years have been resolved which is fantastic – there is a sense of a constantly evolving system, however… these are the cons/frustrations with Kashflow as I see them:

- One contact per customer. This is my biggest bugbear with the system and one I can’t quite believe hasn’t been resolved yet. I quite often have one client company or organisation but with several client contacts. At the moment Kashflow limits you to one contact per organisation and I can see for some businesses that this would simply not be feasible. As it stands, I switch the customer name each time I raise an invoice for a different individual – frustrating! But it does provide a quick fix to the issue. This is a planned improvement according to the Kashflow Suggestion Centre

- Reports. I used to love the Quickbooks reporting functionality of ‘This Quarter’ / ‘Last Quarter’ / ‘This Year’ / ‘Last Year’ etc. You can do this in Kashflow, but you have to manually set the dates which I find a little annoying each time – I lose track of the number of times I have to change the date to 1 April to get my latest P & L for the current year!

- Top Customers & Suppliers. We all have customers and suppliers we work with all the time, and I think it would be lovely to click into Customers / Suppliers on Kashflow and see your top accessed ones right there. Instead they are listed and you either need to scroll or search for their name.

- VAT Checking. Although I really like the VAT functionality I would like a way of seeing the individual transactions that make up a VAT return on screen and ‘ticking them off’ in the way you would with the reconciliation. At the moment I do this by downloading a report and checking that in Excel, but it’s not quite the same. Everything should be correct but it’s nice to look at individual transactions and check for any glaring errors before submission.

- Forecasting. To forecast cash flow and earnings I use a simple Excel spreadsheet and take a few key numbers from Kashflow to insert into the spreadsheet – it would be nice to have this type of feature integrated into the system. According to the Kashflow Suggestion Centre this is being investigated.

Recommendations

Before selecting Kashflow for your business, I’d recommend taking out a trial of the system and conducting every day tasks such as Invoices, Purchases, Reporting and Reconciliation. Free trials of cloud based software makes it very quick and easy to compare systems to each other. That said, I’d highly recommend the system, especially if you’re currently using a legacy system such as a desktop installation. If you’re currently doing all your accounts in Excel, I think Kashflow will be a fairly easy transition although you may need to spend a little time on set up to get your accounts and reports working correctly.

0 Comments on "Kashflow User Review 2014"